Coronavirus has made oil prices drop to USD -60 per barrel. However, there might be someone who could set to benefit from it. Who would benefit from Coronavirus oil prices?

PinterPolitik.com

Based on oilprice.com, oil prices had reaching almost USD -60 per barrel. This price has overwhelmed the upstream oil and gas industry. A lot of drilling activities stopped and or will be stopped because of this condition, confirmed by my friend who was working in one of oil service companies.

I will depict this condition like if we buy gasoline, we will not pay to the seller, but we will be paid by the seller. Two main conditions which affected the oil price falls are the pandemic of Covid-19 all around globe and oil price war. I will explain one by one the causes.

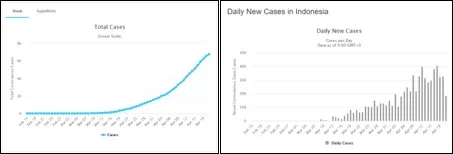

Covid-19 is the X factor that might never be expected before. The global economy falls deeply and expected to be negative economic growth. For the example, Indonesia now has reached 6.760 positives confirmed per April 20, 2020. Indonesia is the higher positive Covid-19 confirmed in ASEAN (see Figure 1).

Due to the impact of the pandemic and various lockdown measures to control the spread of the virus, Indonesian economy is expected to slow sharply in 2020, with GDP growth weakening to 1.0% (see Figure 2). If the pandemic escalates, Indonesia could face its first recession since the East Asian crisis in 1998 (IHS Markit, 2020).

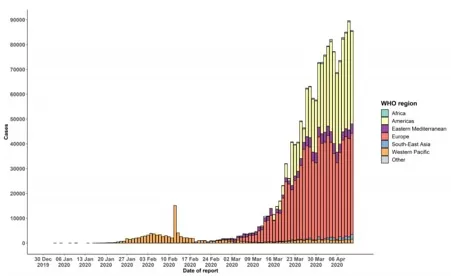

The economic growth will certainly have effects on the energy consumption which effects the extraordinary oil hoarding in the storages. As we know, the basic economic law generally said low supply and high demand increasing the price and vice versa. It is only Indonesia, how about the other countries which have the same conditions, especially China which was the biggest oil importer around the globe (see Figure 3). It is the first factor of the oil price falls deeply.

Besides of the Covid-19 factors, the oil price war or geopolitics are the second factors. The oil price war happened after the OPEC+ conference failed to cuts the production. Since the failure, Kingdom af Saudi Arabia (KSA) and Russia was continuing the flooding of oil production.

The flooding of oil production by KSA and Russia considered by the USA as the effort to crush American oil and gas producers and capture America’s market share and could hindering their economic and national security. For you information, nowadays USA is “like” controlling the global oil price by their shale oil and economic embargo to other countries which have highest oil production, for instance Iraq, Venezuela, and Russia.

It is normal for OPEC+ Countries and Russia not willing to cut their production. It is because of if OPEC+ Countries and Russia cut their production, USA will take over their markets. This second factor is based on the letter of United State Senate Washington, DC 20510-3603 on April 20, 2020.

Since last ten years, US’s oil increased up to 5 million barrels per day compared to 2010 becoming into 13 million barrels per day in 2020. Refer to the amount of production, approximately 4 million barrels or ±31% must sell to the market.

The US production surplus will benefit the US if OPEC+ cuts their production. US also has interests to always make the oil price up to US$ 40 per barrel. This is considering the price of oil production costs in the US ranges US$ 40 – US$ 50 per barrel.

Then, whether USA will lose with conditions like this, USA never runs out of reason. President Trump this morning (23/4) announced to buy the oil for 75 million barrels for US Strategis Petroleum Reserve (SPR), but their storages have been full (Archanda Thahar, 2020).

By considering the current situations, US will likely buy oil with a long-term contract to the manufacturers. The price and delivery-time can adjusted by the consumer or US itself. So, US still has benefits from current situations.

Switch from whether US is benefited or not, let’s see what kind of oil and gas sectors which have the same possibilities like US. In the oil and gas industries, the downstream sectors will benefited.

It is because of the downstream companies still sell the gasoline by some prices, not zero price to the consumers. It is because of price structures depend on some components, those are transportation and marketing, refining cost and profit, and tax. The final price in the society which has evaluated can be a solution for the companies which have the upstream and downstream sectors to survive.

But unfortunately, not all the companies have upstream and downstream simulateneouly. Different companies have their own regulations to survive from this situation and certainly they will always look for possibilities and opportunities.

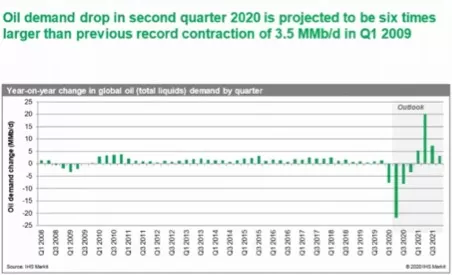

IHS outlook for 2021 to 2022 shows the economic increasing again and reach very high scores (see Figure 2). IHS outlook also shows the oil demand will increasing very high in Q1 and Q2 of 2021 (see Figure 4) if an agreement is made by USA and OPEC+ to cut the production and Covid-19 will end soon.

As the society, we should obey the government rules to overcome these situations together and hope this condition will end soon and everything will go back to its normal life again.

This opinion article belongs to Mutawif Ilmi Muwaffiqih, Undergraduate Student of Geological Engineering at Universitas Gadjah Mada

“Disclaimer: Opini adalah kiriman dari penulis. Isi opini adalah sepenuhnya tanggung jawab penulis dan tidak menjadi bagian tanggung jawab redaksi PinterPolitik.com.”

Ingin tulisanmu dimuat di rubrik Ruang Publik kami? Klik di bit.ly/ruang-publik untuk informasi lebih lanjut.